Derivatives FAQs

A derivative is a contract whose value is based on an agreed-upon financial asset, index or security, often referred to as an underlying asset. Common underlying assets include bonds, equities, commodities, currencies, interest rates, market indexes and credit obligations.

Futures, forwards, options, swaps (including credits default swaps) and warrants are common examples of derivatives. Derivatives can be used to manage risks, often referred to as hedging, or to generate gains, often referred to as speculating.

Derivatives used for hedging allow the purchaser of the derivative to transfer the risk associated with the underlying asset's price to the seller.

For example, a wheat farmer and a miller may enter into a commodity derivative to lock in the future price of wheat. The farmer’s income is at risk from wheat prices falling, and subsequently the miller’s profit is at risk from having to purchase wheat at a higher price; the derivative contract provides a degree of certainty in wheat prices to both parties. In this situation, both parties to the derivative are hedging.

Derivatives used for speculation provide the purchaser with a possibility to make a financial gain, or potentially a financial loss, based on the underlying asset’s price.

For example, a person may enter into a contract that provides an option to purchase shares at a set price believing that the price will rise in the future. If the security’s price rises above the purchase price referred to in the option, the value of the option will increase and the purchaser can exercise the option to purchase the equity below the market price.

In many circumstances, an option will be a hedge for one party to the derivative and speculative for the other party.

For example, a business that imports manufacturing materials from the U.S. is at risk that changes in the U.S.-Canadian dollar exchange rates could increase their costs and make them less competitive. They may enter into a contract with a financial institution to allow them to receive U.S. dollars at a set rate. This protects the manufacturer from changes in the exchange rate, but results in a risk to the financial institution. The financial institution would then decide whether to enter into another contract to transfer the risk.

The following contracts are not derivatives under our rules:

- Gaming and insurance contracts

- Foreign exchange contracts that settle within two days of the trade date, are intended to be settled by delivery of the currency referenced in the contract, or cannot be rolled over under the terms of the contract

- Commodity contracts where physical delivery of the commodity is intended and the contract does not permit cash settlement

- Contracts or instruments traded on recognized exchanges

- Instruments such as warrants, where an issuer of a security is a counterparty and the underlying interest of the derivative is a “security” of the issuer

View Section 2 of Multilateral Instrument 91-101 Derivatives: Product Determination for a detailed description of what types of contracts and instruments are excluded from being considered a derivative.

The BCSC and other Canadian securities regulators have implemented a number of rules relating to OTC derivatives, including rules relating to derivatives including a requirement that derivatives data be reported to a derivatives trade repository.

Reckless trading in credit default swaps was a significant factor in the 2008 global financial crisis. As a result, G20 nations, including Canada, committed to greater derivatives markets transparency and increased capital requirements for derivatives market participants.

Derivatives trade-reporting is the first of these reforms. The data obtained from derivatives trade-reporting will allow the BCSC to monitor and mitigate risk in the derivatives market. It will also allow us to identify abusive trading activities.

People and companies that are reporting counterparties will be affected. In most cases, the reporting counterparty will be a derivatives dealer. Please refer to Companion Policy 96-101 to determine who is a derivatives dealer. Even if a market participant is not a derivatives dealer, they may have the obligation to report.

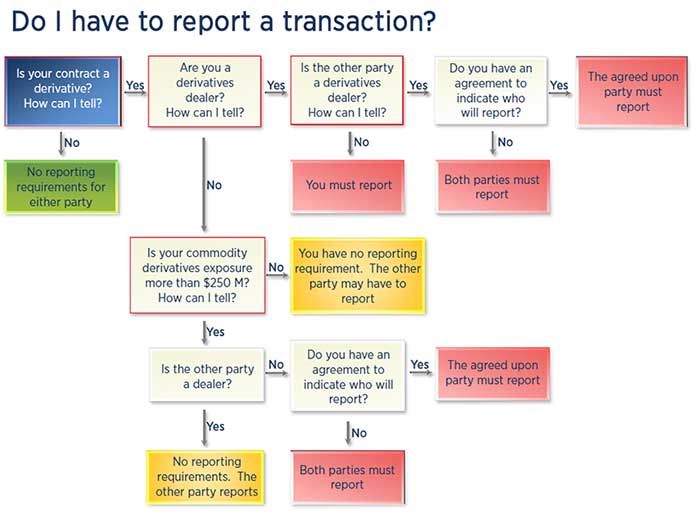

We have created this flowchart to help you determine if you need to report a derivatives transaction.

Who has access to my trade data?

Data available to regulators

Trade repositories will provide electronic access to derivatives trade data to regulators. Access to derivatives trade data allows the regulator to carry out its mandate to protect investors and to ensure fair and efficient markets.

Data available to parties to derivative

Each person that is a party to a derivative, and any person or company acting on behalf of that person, will have access to trade repository data for its derivatives. People and companies wishing to access this data will need to arrange with the applicable trade repository.

Data available to the public

Trade repositories must make aggregated derivatives available to the public, free of charge. Data that is disclosed to the public is required to be broken down into various categories of information, such as currency of denomination, asset class, product type, cleared or uncleared, and maturity (broken down into maturity ranges, such as less than one year, one to two years, two to three years). Publicly available data will be in a format that protects the identity of the parties to the derivative. The names or legal entity identifiers of counterparties must not be published.

In the future, trade repositories will be required to publish transaction-by-transaction data for some classes of actively traded derivatives that will be available for free. This data will provide the public with information relating to the pricing value of derivatives. We anticipate that this data will also be formatted to protect the identities of the parties to the derivative to prevent others from abusing the published information.

We are happy to answer your questions about these requirements. Please contact:

- Michael Brady, Manager, Derivatives, 604-899-6561

- Eric Thong, Derivatives Market Specialist, 604-899-6772

- Faisal Kirmani, Derivatives Market Specialist, 604-899-6846